multistate tax commission member states

A group appointed by the member states that writes rules and regulations interpreting the Uniform Division of Income for Tax Purposes Act. The Certificate itself contains instructions on its use lists the States that have indicated to the Commission that a properly filled out form satisfies.

State Tax Law Changes For The First Quarter Of 2022

1 2018 for many partnerships enacted as part of the Bipartisan Budget Act of 2015 PL.

. This multijurisdiction form has been updated as of June 21 2022. Related Entries in the American Tax Encyclopedia. The Multistate Tax Commission is an intergovernmental tax cooperative agency that was born from the multistate tax compact law.

Important changes in the federal partnership audit rules began to apply for tax years beginning Jan. Commission members acting together attempt to promote uniformity in state tax laws. Zacarias Quezada a manager with Marcum LLP provides an overview of the limitations of the law and what it means for businesses.

Commissioner of Revenue Massachusetts Supreme Judicial Court No. 444 North Capitol Street NW Suite 425. The Multistate Tax Commission or MTC is a United States intergovernmental state tax agency 1 created by the Multistate Tax Compact in 1967.

For further information please contact. The Multistate Tax Commission is an interstate instrumentality located in the United States. Its purpose is to create uniformity amongst state tax laws and foster fair equalization of tax base revenues.

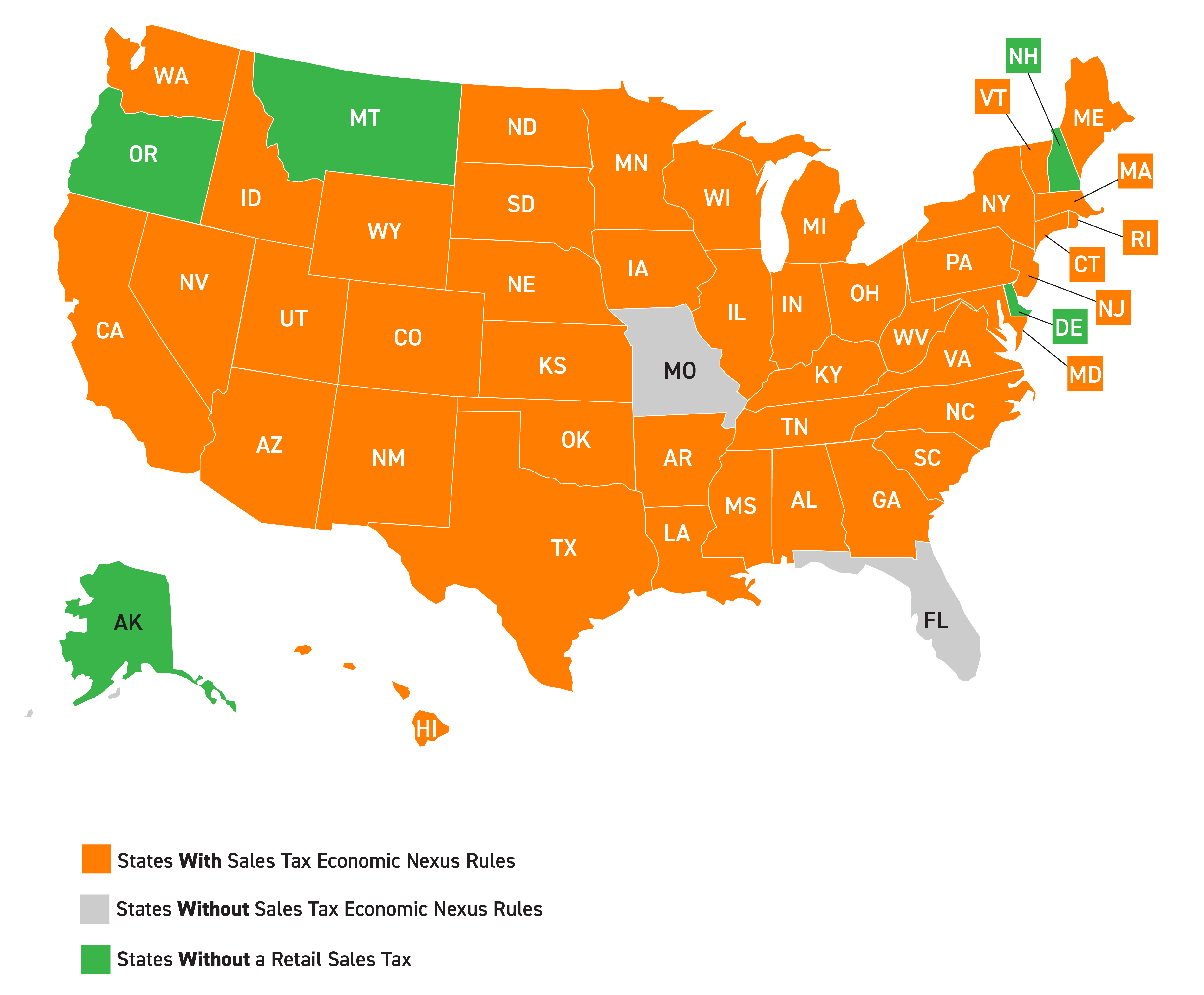

The Multistate Tax Commission MTC recently updated its guidance on PL. 2 As of 2011 47 states are members of the Commission in some capacity. An intergovernmental state tax agency whose mission is to promote uniform and consistent tax policy and administration among the states assist taxpayers in achieving compliance with existing tax laws and advocate for state and local sovereignty in the development of tax policy.

Compact member states also help to govern the Multistate Tax Commission and regularly participate in a wide range of the Commissions projects and programs. MEMBERS OF BBB NATP. 86-272 which deals with net income tax including a new section on businesses that interact with customers online and make digital sales.

Bolton overviewed the responses of 24-member states to an informal SITAS. The compact member states are Alabama Alaska Arkansas California Colorado District of Columbia Hawaii Idaho Kansas Michigan Minnesota Missouri Montana New Mexico North Dakota Oregon South. 3 Commission members acting together attempt to promote uniformity in state tax laws.

The Multistate Tax Commission a multistate agency made up of state taxing authorities whose aim is to encourage uniform state tax laws has adopted after several months consideration a uniformity recommendation ie a model statute that requires partnerships to withhold income tax at the states highest tax rate on each nonresident partners share of the. The Commission has developed a Uniform Sales Use Tax Resale Certificate that 36 States have indicated can be used as a resale certificate. This allows multistate tax payers to properly apportion their tax liabilities in a manner that does not.

At issue in the case is whether Massachusetts had the statutory and constitutional authority to impose its income tax on the capital gain income recognized by an out of state. Michigan Minnesota New Jersey Rhode Island West Virginia Arizona California FTB. In the fall of 2018 the MTCs Uniformity Committee tasked a work group consisting of representatives from a dozen states to update the Statement Concerning Practices of the Multistate Tax Commission and Signatory States Under Public Law 86-272 the Statement to consider how the law applies to modern business activities.

A The Multistate Tax Commission is hereby established. Arkansas Colorado District of Columbia Hawaii Idaho Kansas Missouri Montana New Mexico North Dakota Oregon Texas Utah Washington Georgia Kentucky Louisiana. The Statement which is an.

Multistate Tax Commission means. The Procedures of Multistate Voluntary Disclosure govern the NNP staff and member states during the process. Get a brief overview of Multistate Tax and see our current team of knowledgeable and dedicated employees.

The Multistate Tax Commission has filed an amicus brief in the case of VAS Holdings and Investments LLC v. 15 2019 the IRS is expected to begin to conduct audits using the new partnership audit regime in 2020. As of 2021 the District of Columbia and all 50 states except for Nevada are members in some capacity.

114-74With extended 2018 partnership returns timely filed by Sept. Rest easy knowing your taxes will be properly handled every single year with the help from the experienced team at Multistate Tax Inc. The Multistate Tax Commission MTC is set to revamp its transfer pricing collaboration and enforcement initiatives following the first public meeting of its State Intercompany Transactions Advisory Service SITAS Committee in over four years.

Please contact the Commission staff member noted as an. Establishes a commission whose purposes are 1 to facilitate proper determination of state and local tax liability of multistate taxpayers 2 to promote uniformity and compatibility in significant components of tax systems 3 to facilitate taxpayer convenience and compliance 4 seeks to avoid duplicate taxation 5 conducts audits of major corporations on behalf of. It is the executive agency charged with administering the Multistate Tax Compact.

In 1986 the MTC adopted the Statement of Information Concerning Practices of Multistate Tax Commission and Signatory States Under Public Law 86-272 which sets forth the MTC signatory states interpretation of those in-state activities that are conducted by or on behalf of a corporation and fall within or outside the protection of PL. It shall be composed of one member from each party State who shall be the head of the State agency charged with the administration of the types of taxes to which this compact applies. Director National Nexus Program.

Multistate Tax Commission With Helen Hecht Taxops

Implementing Recent Mtc Guidelines Pl 86 272 And The Finnigan Method Cpe Taxops

3 Tips For Filing Taxes In Multiple States Credit Karma

Multistate Tax Commission News

Multistate Tax Commission S View Of P L 86 272 Is Changing

State Tax Law Changes For The First Quarter Of 2022 Hayashi Wayland

Multistate Tax Commission Home

Multistate Tax Commission Home

Forty Two States Have Now Adopted Marketplace Sales Tax Collection Laws Multistate

Multistate Tax Commission News

.jpg.aspx)

Multistate Tax Commission News

Multistate Tax Commission Home

To Obtain A Copy Of The Request For Information Rfi Multistate Tax

To Obtain A Copy Of The Request For Information Rfi Multistate Tax